Selecting ideal Car Insurance involves understanding individual needs and evaluating various coverage types. Factors like vehicle type, age, budget, and driving history determine policy choices. Select Car Insurance offers comprehensive protection, with discounts for safer drivers and specialized plans catering to high-value cars, students, and performance vehicles. Compare quotes from multiple providers to find tailored, cost-effective coverage aligned with unique requirements.

Reliable protection is essential for all drivers, ensuring peace of mind on the road. This article guides you through the process of understanding your unique needs and selecting the best Car Insurance. We’ll explore tailored policies that fit diverse driving profiles, highlighting key features to look out for. By navigating various options, you’ll gain insights to make an informed decision when selecting Car Insurance, ensuring comprehensive coverage without compromise.

- Understanding Your Needs: Tailoring Car Insurance to Fit All Drivers

- Key Features of Reliable Car Insurance Policies

- Navigating Options: How to Select the Best Car Insurance for You

Understanding Your Needs: Tailoring Car Insurance to Fit All Drivers

Understanding your individual needs is the first step in selecting the perfect Car Insurance policy. Every driver has unique circumstances that influence their risk profile and coverage requirements. For instance, insuring a luxury car necessitates specialized coverage options to account for its higher value and specific maintenance needs. On the other hand, affordable car insurance for seniors often incorporates discounts and simplified policies designed to cater to changing driving patterns and mobility.

This personalized approach ensures that your Car Insurance is not only reliable but also cost-effective. Good student discounts on auto insurance, for example, recognize the safer driving habits of young, responsible students, while personal liability insurance definition outlines the protection against financial loss in case of accidents caused by you to others or their property. By thoroughly evaluating these factors, drivers can make informed decisions and select a policy that offers comprehensive protection tailored to their specific needs.

Key Features of Reliable Car Insurance Policies

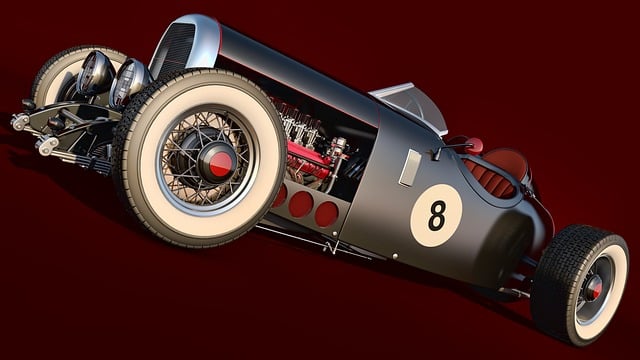

When looking into reliable car insurance policies, there are several key features to consider that go beyond simply finding the cheapest option. Select Car Insurance policies often come with comprehensive coverage, which protects against a wide range of risks, from accidents and theft to natural disasters and vandalism. This is particularly important for high-value vehicles, including classic cars, where a single incident could result in significant financial loss.

Additionally, understanding the difference between comprehensive vs collision coverage is crucial. While comprehensive covers most unforeseen events, collision coverage specifically addresses damages resulting from accidents involving another vehicle or object. For those with high performance vehicles, specialized insurance plans that cater to these unique and often expensive cars can offer tailored protection, including specific coverage for racing events and modified parts. Even essential policies for auto insurance for college students should include adequate liability and medical coverage to safeguard against potential risks on the road.

Navigating Options: How to Select the Best Car Insurance for You

Navigating the world of car insurance can be a daunting task, but understanding your options is key to finding reliable protection. When selecting Car Insurance, consider your specific needs and preferences. Start by evaluating your budget; insurance plans vary widely in price, with factors like coverage limits, deductibles, and additional perks influencing costs. Remember, higher coverage might offer more protection but could also mean larger premiums.

Next, assess the types of coverage available. Basic liability covers damages you cause to others, while comprehensive and collision policies protect against various risks, including theft, vandalism, and natural disasters. You can tailor your policy by choosing specific add-ons like a good student discount on auto insurance for teens or specific coverage for valuable items in your car. How you shop for car insurance matters; compare teenager car insurance quotes from multiple providers to find the best value for your needs.

When it comes to choosing the right car insurance, understanding your unique needs and navigating the available options is key. By evaluating essential features like coverage limits, deductibles, and add-ons, you can tailor a policy that suits your driving profile and budget. Remember, reliable protection isn’t just about meeting minimum requirements; it’s about selecting Car Insurance that offers peace of mind and financial security when you need it most. Take the time to research, compare, and choose wisely to ensure you’re covered for any eventuality on the road ahead.