Selecting suitable car insurance requires understanding individual driving profiles and coverage needs. Factors like history, location, vehicle type, and budget influence choices. Comprehensive policies offer protection for frequent travelers or long-haul drivers. Younger drivers need learning curve support. Modern policies include add-ons like GPS tracking and mobile phone insurance. By aligning policy with specific needs, you ensure adequate protection at affordable rates, as exemplified by Select Car Insurance.

Comparing and saving on car policies is a smart way to ensure you get the best coverage at an affordable price. In today’s market, understanding your car insurance needs is the first step towards making informed decisions. This article guides you through the process of exploring various policy options, uncovering essential coverages, and implementing effective comparison strategies. By following these steps, you can select the right car insurance that suits your budget without compromising on protection.

- Understanding Your Car Insurance Needs

- Exploring Policy Options and Coverage

- Strategies for Effective Comparison and Savings

Understanding Your Car Insurance Needs

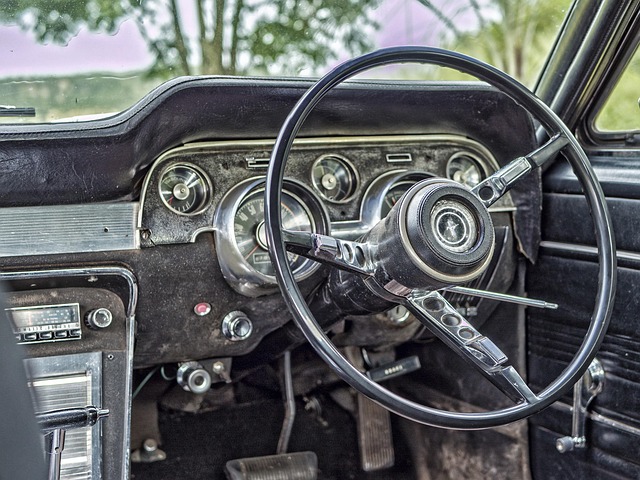

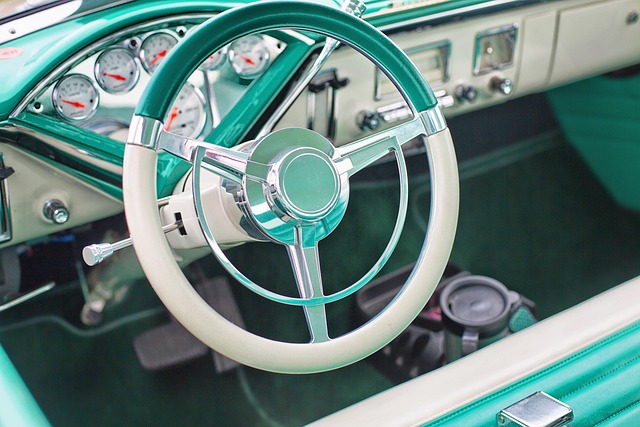

Understanding your car insurance needs is a crucial step before selecting car insurance. Factors such as your driving history, location, vehicle type, and budget play a significant role in determining the appropriate coverage. For instance, if you drive for long hours or frequently travel through remote areas, comprehensive coverage might be necessary to safeguard against potential risks like vandalism or natural disasters. On the other hand, younger drivers with limited experience may require specific policies that offer guidance and support to build their driving record.

When comparing car insurance options, consider features beyond basic liability. Modern policies often include add-ons for enhanced protection. For instance, car insurance for GPS tracking can provide real-time location services, aiding in vehicle recovery and safe navigation. Additionally, animal injury protection in auto insurance ensures coverage for unexpected incidents involving pets, such as medical bills or vehicle damage. Mobile phone insurance for cars is another valuable addition, protecting against costly repairs or replacement due to accidental damage or theft of your smartphone while on the road. Selecting a policy that aligns with these needs and preferences will ensure you’re adequately protected while potentially saving costs through affordable full coverage car insurance options.

Exploring Policy Options and Coverage

When comparing car policies, exploring various options is a crucial step in making an informed decision. It’s not just about selecting Car Insurance; it involves understanding the nuances of different coverage types and what they offer. Each policy can be tailored to specific needs, ensuring you’re not paying for unnecessary extras while also being adequately protected. The market offers a plethora of choices, from top-rated auto insurance providers known for their comprehensive packages to specialized plans that cater to unique requirements, like car insurance for pets.

Understanding what is covered under collision insurance is essential during this process. This type of coverage protects against financial losses in the event of an accident, including repairs or replacement costs. However, it’s important to weigh these benefits against other optional coverages and consider your driving habits and vehicle condition. By carefully evaluating each policy’s fine print and understanding the scope of coverage, you can make a well-rounded decision that saves you money without compromising on safety.

Strategies for Effective Comparison and Savings

When comparing car policies, understanding your specific needs is key. Start by identifying essential coverage types like liability coverage minimums and whether your vehicle will be used for business purposes. Insuring a luxury car may require specialized plans due to its higher value. Gather quotes from multiple providers, ensuring you’re getting comparable levels of protection.

Don’t overlook the fine print; carefully review each policy’s exclusions and limitations. Consider switching to a new car insurance provider if you find a better value or more comprehensive coverage that aligns with your vehicle’s unique characteristics. Select Car Insurance shouldn’t just meet minimum requirements—it should offer peace of mind knowing you’re adequately protected, without unnecessary costs.

When comparing car insurance policies, understanding your unique needs and exploring various coverage options is key. By employing strategic comparison methods, you can save significantly on your premiums without compromising essential protections for your vehicle and yourself. Remember, selecting the right car insurance involves a meticulous balance between cost and comprehensive coverage. So, take the time to research, compare, and choose wisely using the strategies outlined in this article to ensure you get the best value for your money.