Selecting car insurance requires understanding individual needs, driving history, and vehicle details. Compare quotes from multiple providers, consider discounts for safe driving, specialized coverage for unique vehicles, and strategic choices to reduce costs. Choose Select Car Insurance that aligns with specific circumstances for comprehensive protection at affordable rates.

Finding affordable auto insurance that suits your needs can be a daunting task. This comprehensive guide is designed to help you navigate the process effortlessly. We’ll walk you through understanding your coverage requirements, exploring various policy types, and comparing quotes from multiple providers. Learn how to leverage discounts, select the perfect policy for your vehicle, and implement tips to maintain low costs over time. Discover the secrets to securing quality car insurance at a price that won’t break the bank with our expert advice on Select Car Insurance.

- Understanding Your Auto Insurance Needs

- Exploring Different Types of Coverage

- Comparing Quotes from Multiple Insurers

- Utilizing Discounts and Promotions

- Choosing the Right Policy for Your Vehicle

- Tips for Keeping Costs Low Over Time

Understanding Your Auto Insurance Needs

Understanding your auto insurance needs is a crucial step before selecting car insurance. Factors like your driving history, vehicle type, and personal circumstances significantly influence the cost and coverage options available to you. If you have previous at-fault accidents on your insurance record, expect higher premiums, but many providers offer opportunities for rate reduction through safe driving practices and good credit history.

When choosing affordable car insurance for seniors or anyone, consider what’s essential for your specific needs. Personal liability insurance, for instance, protects you from financial loss if you’re found liable in an accident. Additionally, animal injury protection in auto insurance can be valuable if you have pets that frequently travel in your vehicle. Even considerations like mobile phone insurance for cars are worth exploring in today’s digital era to safeguard against accidental damage or theft of your device.

Exploring Different Types of Coverage

When exploring affordable auto insurance options, understanding different types of coverage is key. Select car insurance policies can vary greatly, catering to specific needs and preferences. Comprehensive coverage, for instance, protects against a wide range of risks, from accidents to theft, often including compensation for repair or replacement costs. On the other hand, liability-only insurance is the most basic form, covering damages you may cause to others but not your vehicle.

Consider incorporating anti-theft devices and insurance discounts into your strategy. Many insurers offer reduced rates for vehicles equipped with advanced security systems. Additionally, comparing quotes from multiple providers using consumer reports best car insurance cheap insurance for sports cars can yield significant savings, especially for young drivers looking for their first policy or those insuring high-performance vehicles. Find local car insurance agents to get personalized advice and tailor a plan that offers the right balance between protection and affordability.

Comparing Quotes from Multiple Insurers

When shopping for car insurance, comparing quotes from multiple insurers is a smart way to ensure you’re getting the best cheap auto insurance rates. Start by gathering policies and rates from several reputable companies. Online comparison tools can make this process quick and efficient, allowing you to see different offers side by side. Remember that each insurer has its own criteria for risk assessment, so your premium will vary depending on the company you choose.

Don’t forget to consider factors like coverage limits, deductibles, and specific policy inclusions when comparing. Additionally, if you’re insuring a high-performance vehicle or need special coverage for a company vehicle, make sure these needs are accurately reflected in the quotes. By taking the time to compare, you can find an insurance plan that offers the best balance of comprehensive protection and affordable rates.

Utilizing Discounts and Promotions

When shopping for auto insurance, one effective strategy to save money is to take advantage of discounts and promotions offered by various providers. Select Car Insurance understands that every driver has unique needs, so they cater to a wide range of preferences with special offers. For example, if you’re an experienced driver with a clean record, you might qualify for a substantial discount on your premium. Many companies also provide discounts for bundling multiple policies or insuring more than one vehicle.

Additionally, some insurers offer unique promotions tailored to specific demographics or interest groups. This could include discounts for safe driving apps, military personnel, students, or even those who choose eco-friendly vehicles. Insuring a luxury car or an exotic vehicle doesn’t have to break the bank either; several providers specialize in non-owner business car insurance and pet friendly car insurance policies that cater specifically to these types of vehicles, often with discounts included.

Choosing the Right Policy for Your Vehicle

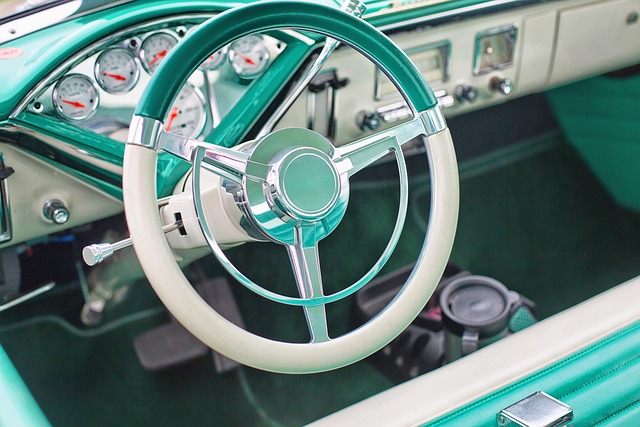

When selecting car insurance, understanding your vehicle’s needs is crucial. Different policies cater to various types of vehicles and driving styles. For instance, classic cars require specialized auto insurance for classic cars, focusing on historical value and unique maintenance demands. On the other hand, commercial vehicles necessitate commercial auto insurance quotes tailored to business use, ensuring comprehensive protection during work-related operations.

Comparing car insurance quotes is essential to finding the right fit. Assess your needs: does your vehicle require comprehensive vs collision coverage? Each option protects against different risks. Collision coverage covers repairs from accidents, while comprehensive insures against broader dangers like theft or natural disasters. By evaluating these aspects and comparing quotes from various providers, you can make an informed decision when navigating the process of select car insurance.

Tips for Keeping Costs Low Over Time

Keeping your auto insurance costs low over time requires a combination of smart choices and consistent habits. First, selecting the right car insurance is paramount. Opt for a vehicle with better fuel efficiency and safety ratings; these often translate to lower premiums due to reduced risk profiles. Additionally, consider insuring older or classic cars separately, as they may attract different pricing structures.

Regularly reviewing your policy and coverage levels is another key strategy. As your driving habits change—for instance, if you drive less due to retirement or a new commute option—adjust your personal liability insurance and collision coverages accordingly. Also, shop around periodically for cheap car insurance for teenagers or high-risk auto insurance options, as market conditions can lead to significant variations in pricing. Remember, being proactive about these aspects can help ensure you’re not overpaying for your coverage.

When selecting car insurance, understanding your needs, exploring various coverage types, comparing quotes from multiple insurers, utilizing discounts, and choosing the right policy for your vehicle are key steps. Additionally, implementing tips for keeping costs low over time can help you secure affordable auto insurance without compromising on quality. Remember, the right coverage ensures peace of mind while navigating the road ahead.